Author:DavisDate:2024-5-25

In the first half of this year, after Tesla launched the first price cut, BYD and Ideal followed suit one after another. The domestic new energy vehicle market launched a new round of price cuts, and the pressure was quickly transmitted to the upstream automotive chip suppliers.

According to industry consensus, the average number of chips used in an electric vehicle is twice that of a traditional fuel vehicle. Therefore, with the popularity of electric vehicles in recent years, the automotive semiconductor market has exploded.

After experiencing the global chip shortage in 2021 and the consumer electronics winter in 2022, the demand for the automotive chip market has only increased, and is unprecedentedly strong.

Especially in 2023, compared with the decline in revenue and profits of consumer electronics chip giants such as Intel, Qualcomm, and Samsung, automotive electronics chip manufacturers such as Infineon and NXP generally experienced growth. Infineon’s revenue last year and profits soared by 15% and 30% respectively, refreshing the company's historical record.

However, starting from 2024, the new energy electric vehicle industry began to slow down, and vehicle sales declined significantly. Tesla also began to reduce layoffs after delivering its worst annual report in four years. From February to April this year, domestic new energy vehicle sales experienced an unprecedented "three consecutive declines."

Automotive chip companies have also felt the sluggish demand in the industry, and the price reduction strategies of car companies have put these suppliers under direct pressure: the price of complete vehicles has been reduced, and in order to control costs, they need to further require price reductions of auto parts, and the unit price of chips has shrunk.

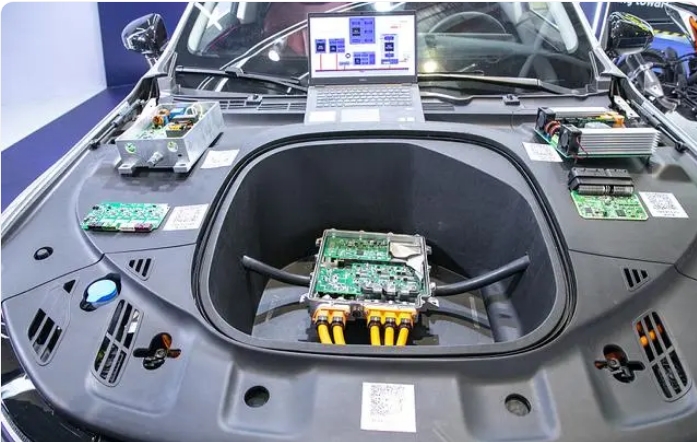

Automotive semiconductors mainly include three categories: control chips, power semiconductors, and sensor chips. Due to the limited application scale in traditional fuel vehicles, prices and profit margins are generally low, far lower than consumer electronic semiconductors such as CPUs and GPUs.

Cao Yanfei, senior vice president of Infineon Technologies and head of the automotive business in Greater China, also said in a recent interview with the media that the company has truly felt the "volume" of China's new energy vehicle industry on the front line, especially in the past year or two, technology has , all aspects of cost are very prominent. He believes that in the short term, electrification in some areas has indeed slowed down this year, but intelligence and low-carbonization are a certain future in the long term, and what we are encountering now are more of "phased challenges or adjustments."

At the same time, he believes that in the face of the short-term development slowdown of new energy vehicles, instead of "rolling up prices" on traditional low-end automotive semiconductor products, Infineon pays more attention to the layout of silicon carbide (SiC), gallium nitride ( GaN) and other third-generation semiconductor materials, strengthen technological innovation, and enhance the value of power semiconductors and other automotive chips themselves are also more worthy of pursuing long-term goals.

The "onboarding" of third-generation semiconductors is currently a growth trend that the industry is paying attention to. Compared with traditional silicon materials for chips, third-generation semiconductors such as silicon carbide and gallium nitride have a larger band gap width (also known as wide band gap semiconductors), and the band gap width directly determines the conductive properties of the semiconductor, so The third generation of semiconductors is more suitable for working in high voltage, high temperature and high frequency environments. In recent years, silicon carbide has become more popular than gallium nitride and has been widely used in new energy, electric vehicles, charging piles, energy storage and other fields. At present, the cost of silicon carbide materials is higher than that of traditional semiconductor materials, and the corresponding product prices are also more expensive. Further popularity depends on scale to reduce unit costs, which has also led to a new round of expansion in the global automotive semiconductor market.

Domestic manufacturers are also catching up on this track. This week, domestic power semiconductor manufacturer Silan Micro has issued a listed company announcement to launch an 8-inch silicon carbide power device chip manufacturing production line project with a total investment of up to 12 billion yuan. Manufacturers such as Tianyue Advanced and Xinlian Integration also have large-scale projects under construction.

↑Previous [ Behind the overseas sales of “San beng zi”: a reflection of China’s manufacturing strength ]↓Next [ National Development and Reform Commission: Multiple measures to consolidate and expand the development of the new energy vehicle industry ]